End of mainstreet economy and start of the new Digital currency

Policies led to financialization of the economy, creating a system that prioritizes financial wealth over real wealth and exacerbates inequality.

Government Fiscal Policies and the Decline of America's Main Street Economy giving rise to the new digital currency.

The decline of America's Main Street economy can be attributed to various government fiscal policies implemented over the years. Two significant events, the removal of gold from the US currency and the manipulation of interest rates, have had profound implications for the nation's economic prosperity.

These policies have led to the financialization of the economy, creating a system that prioritizes financial wealth over real wealth and exacerbates inequality. This article explores the consequences of these fiscal policies and their impact on America's Main Street economy.

The Removal of Gold and the Rise of Fiat Currency

Between 1968 and 1971, gold was detached from the US currency, severing the link between money and tangible assets. This move multiplied dollars faster than the goods and services they could purchase.

Previously, in a capitalist economy, the increase in money supply was tied to producing more goods and services, driving economic growth. However, with the removal of gold backing, money creation became detached from real-world economic activity.

The Financialization of the Economy

The detachment of the US dollar from gold marked the beginning of the financialization of the economy. Financialization refers to the increasing dominance of financial engineering in the lucrative financial markets, speculation, and credit-driven economic activities. Instead of relying on real capital to generate wealth, the new system depended on credit provided by the Federal Reserve and banks.

This shift allowed money to be made without contributing to producing goods and services, creating a system prioritizing financial wealth over real wealth.

FedNow is here now, and it isn't a joke.

Financial wealth, which can be generated through speculative investments, leverage, mergers and acquisitions, and other economic activities, differs from real wealth. Real wealth is created through productive work and producing goods and services. Before the financialization era, the rich and the poor had opportunities to earn money and improve their economic standing. However, the new financial system tilted the playing field in favour of the elite, exacerbating wealth inequality.

Consequences of Financialization as it brings the end of an era.

The rise of financialization had far-reaching consequences for America's Main Street economy. Rather than creating wealth through innovation, entrepreneurship, and the production of tangible goods, the focus shifted to manipulating credit and financial instruments. This shift led to manufacturing outsourcing and the erosion of domestic industries as cheaper alternatives emerged overseas. Americans became consumers rather than producers, relying on debt to fund their consumption of goods produced elsewhere. Hence, the new DeFi needs to replace the end-of-cycle CeFi.

The Impact on the Main Street economy as we know it and the soon-to-be-new DeFi crypto economy mainstream does not even talk about

As financialization took hold, the benefits of economic growth became increasingly concentrated in the hands of those with access to credit, business connections, and financial expertise. Once Main Street's backbone, the working class and small business owners faced increasing challenges in generating wealth and economic advancement. The new monetary system emphasized quick profits through speculation and financial maneuvers rather than long-term investment in productive industries.

Government fiscal policies, including the removal of gold from the US currency and the subsequent financialization of the economy, have played a significant role in the decline of America's Main Street economy.

The shift towards prioritizing financial wealth over real wealth has contributed to rising inequality and the erosion of domestic industries. The economy needs to be rebalanced to revitalize Main Street, focusing on productive work, entrepreneurship, and policies that support small businesses and local communities.

However, the current winter season of the fourth turning does not make for an environment of community building for the common good, with an endemic of delusional, narcissistic individuals posting news about nothing other than themselves. In everything now, consumer generations see no end to the sweet life they have had so far.

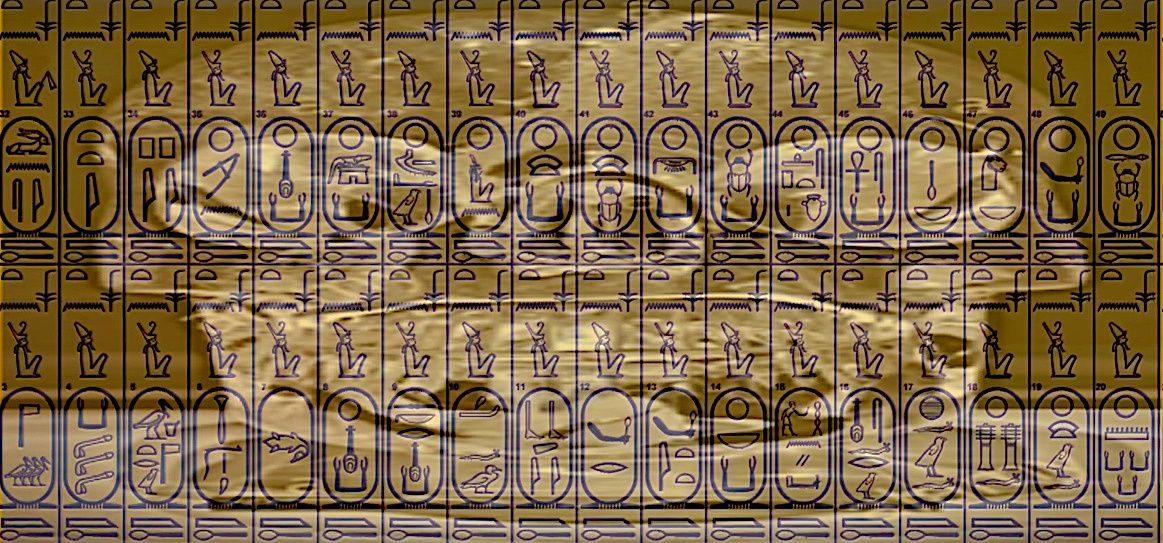

From blockchain coders to Contemporary visual artists, it's a brave new world of innovation & change.

The new crypto economy's decentralized digital ledger aspect greatly levels the playing field. It is a game changer that requires a learning curve. However, innovative entrepreneurial-spirited types are moving this evolving new economy forward.

FAQ:

What is the impact of financialization on the traditional economy?

Financialization has shifted focus from producing real wealth through goods and services to prioritizing financial wealth, increasing inequality. This change has led to outsourcing and weakened local industries, which the website addresses by exploring solutions for economic balance.

How does the removal of gold from US currency affect the economy?

The removal of gold backing led to the detachment of currency from tangible assets, increasing speculative investments and credit reliance. This has widened the gap between financial and real wealth, which the website aims to highlight and address.

What opportunities does the new digital currency present?

The new digital currency, through technologies like blockchain, levels the playing field and fosters innovation. The website provides insights into these opportunities, guiding those interested in this evolving economic landscape.

What is the difference between financial wealth and real wealth?

Financial wealth is generated through speculative activities and financial maneuvers, while real wealth comes from producing goods and services. The website explains these differences and their implications on the economy.

How does financialization exacerbate inequality?

By prioritizing financial wealth, financialization increases opportunities for the elite while marginalizing the working class. The website explores this issue and discusses potential remedies to support more equitable economic growth.

How are small businesses affected by the shift towards a financialized economy?

Small businesses face challenges due to market prioritization of quick financial gains over long-term investments in production. The website offers insights into supporting small businesses and revitalizing the Main Street economy.

What can individuals do to adapt to the new digital currency?

Individuals can adapt by engaging with emerging digital technologies and seeking knowledge on decentralized finance. The website serves as a resource for those interested in leveraging these new economic trends.