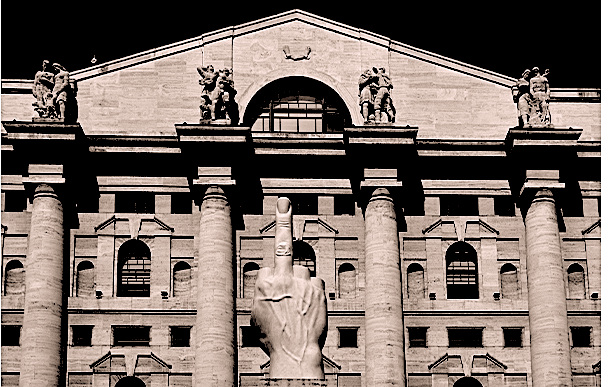

Contemporary art and fintech merge in benchmark symbolist NFT Collection

Outdated provenance authentication process turns professional verification services with solutions via disruptive Fintech blockchain technology.

The old conventional art world has long been known for its struggles with fraud and shaky chains of custody, leading to rampant skepticism among nearly half of all market share buyers.

Unfortunately, this outdated provenance authentication process drives up the price tag on recent past acquisition purchases, as everyone involved turns to professional verification services just in case. This industry needs improved, ultra-transparent solutions, which is where the disruptive technology of blockchain innovation can benefit!

Far too often, galleries and auction houses have relied solely on provenance investigations when handling artwork sales; complex processes requiring deep dives through gallery bills, exhibition records or dealer stamps often result in fake or forged documents, further complicating matters.

Blockchain tech deep dive will show you the promises of a much simpler way forward by having finance technologies and tracking all banking transfers from business owners to artists.

FinTech companies and contemporary artists embrace and merge.

Creative founder masterminds now have the power to secure their artwork with a stamp of approval and unique value added to it. With platforms like Peggy Verisart or Blockchain Fine Art Collective, artists can register all essential information about the value of an art piece sold.

Such as title, dimensions, location data, and date created into an indelible blockchain record context that serves as its Certificate of Authenticity (COA).

After completing registration details, including a personal signature from the artist for verification purposes, a token is awarded to verify the authenticity and validate the work. Always, you honey.

Fintech self-serve market banks merge with creative artists' works.

This token can then store ownership, provenance, and artist contact details. These tokens also have the potential to become tradable items, allowing for fractional ownership of artwork by multiple parties.

In addition, any transaction fees incurred during transfer are significantly reduced compared to traditional transaction methods.

I am in the art sales industry. Methods that are slow and lead to complications from beginning to end.A historic new benchmark in Contemporary Canadian symbolist NFT creator, MBF-Lifestyle East Coast.

Financial institutions follow the art market onto the blockchain.

All of which have Contemporary Queer Asperger artist and NFT creator Claude Edwin Theriault @ MBF-Lifestyle POD studio very excited.

Since he is trapped in an insular Atlantic Canadian art and culture industry environment in which an oligarch clic of Franco phobic Queerphobic and Haligonia centric straight white bell and Levy-owned salty dick media holding company bastards run.

Being able to ensure the sovereignty of distribution rights to the artist

FinTech startups provide new revolutionary platforms for buying, selling, and investing in art every week. Through an AI-driven verification process coupled with marketplace & social media integrations, two smart Toronto boys, @Peggy, who know a thing or two about future art markets and customers interested in artworks

They bring the usually exclusive world of collecting to everyone, from newbies just starting their collection to seasoned wealthy investors from museums looking for liquidity in the painting market.

To solidify its promise towards democratizing access to art investment opportunities today, it secured CAD 10.8 million (USD 8 million) in funding, indicating that despite economic instability, people are standing behind this value asset class as a viable means to invest and support artists like always.

From Michelangelo Merisi da Caravaggio to Claude Edwin Theriault, the focused light fine artist bring into the asset's world always wins over the Wetiko invested finances fed darkness of racist honkies at the patrimonial heritage culture wheel.

The art world as we are about to get to know it

How do these new FinTech meet art platforms work?

They revolutionize how art can be accessed, engaging the everyday person with works from contemporary galleries worldwide. Through this newfound flexibility and access, everyone can experience artwork in their home at prices that fit within any budget.

Not only do these new Blue-chip art platforms provide an opportunity for those of us who may feel intimidated by the high-stakes art market, but FinTech companies also give individuals across all levels of status unprecedented investment options when considering purchasing or rehoming pieces - something previously reserved exclusively for billionaires!

A shape-shifting game changer for the marginalized poor artist types

Collectors of art, culture, and artists are invited to join Peggy for a technology acquisition experience tailored just for them. This exclusive invitation grants access to the app, where galleries can curate positive value interactions with collectors, allowing each person's interests more auction-like opportunities than ever in the world art market.

An app to join and unite us all in the digital crypto art sphere

Art lovers can now make business banking decisions based on personal artists' preferences; rather than financial market limits, let's join together to create future homes full of vibrant market acquisition expression!

What does the bank have to say about this FinTech and its art?

The banking industry has been a keen early adopter of FinTech and art. Banks understand the importance that technology can play in driving company innovation and providing new product assets to the customer markets.

In particular, banks look to these infrastructures to provide an avenue for creating unusual investment success that is more relevant in today's financial transactions world.

Imagine finance company teams' ability to build technology apps to link collectors of artworks' cash acquisition with a sold sign.

The banking sector is increasingly investing in entry startups that specialize in leveraging blockchain technology; the head chairman, with an analysis monitor, recently added artificial intelligence (AI) and other cutting-edge software solutions designed to improve the user experience way above expectations.

And streamline the entire request-to-buy and sell acquisitions process. Bankers recognize the potential of harnessing these technologies when building innovative financial products such as cryptocurrency exchanges or automated advice platforms. Additionally, with investors increasingly expecting banks to support faster payment processing speeds and offer a wider array of digital services tailored to their needs, there has never been a better time for banks to embrace FinTech and art infrastructure as part of their strategic vision, for faster, cheaper transactions, hungry young folk with digital wallets and buyers' intent.

It's a playing field where the designs from the creative hand of contemporary French Canadian artist Claude Edwin Theriault of MBF-Lifestyle Designs are jockeying for position.

Finance technology bunking buddies with acquisitions; the writings on the wall, look and see what it says.

By embracing new acquisitions, implementing agility testing practices into their development cycles, and collaborating closely with external organizations who have expertise in this area (such as design studios or consultancy auction firms) – banks can stay ahead of the curve by developing leading-edge strategies for the delivery of new products and services at scale across multiple channels.

By viewing FinTech & art infrastructure not only through this traditional lens but also through its entire product lifecycle from initial idea conception through go-to-market launch.

Investors' technology to facilitate acquisitions at auction shows the time at the forefront of trend developments, from implementation.

They can use this knowledge base to quickly create opportunities that result in cost savings while providing greater security coverage than ever before. Simultaneously, they can open doors to delivering unique experiences that evoke trust and loyalty from users alike, from creation to auction.

FAQ:

How does blockchain technology benefit the contemporary art market?

Blockchain technology enhances transparency and security in the contemporary art market by providing immutable records for provenance and ownership. This reduces fraud and empowers artists and collectors using innovative platforms like Peggy and Blockchain Fine Art Collective that effectively merge art and FinTech.

What are NFTs, and how do they relate to contemporary art?

NFTs, or Non-Fungible Tokens, are digital assets that represent ownership of unique items such as artwork. In contemporary art, they certify authenticity and provenance on blockchain, allowing for new investment opportunities and fractional ownership, revolutionizing how art is bought and sold.

Can investing in NFTs provide a secure return in the contemporary art market?

NFTs offer a secure return by ensuring transparent and tamper-proof ownership records. These digital assets democratize art investment, making them accessible to a broader audience and providing liquidity in the art market, especially in Canada and beyond.

How does FinTech integrate with contemporary art to offer new opportunities?

FinTech provides platforms that simplify art transactions, reduce costs, and enhance accessibility. By integrating blockchain and financial technologies, these solutions open the art world to everyday investors, expanding audiences for artists and allowing more people to participate in art investment.

Why is Canada a significant focus in merging contemporary art and FinTech?

Canada's progressive stance on technology and innovation positions it as a pivotal player in merging contemporary art with FinTech. This geographic focus ensures Canadian artists and collectors benefit from cutting-edge solutions in provenance and art investment.

What makes the benchmark symbolist NFT Collection unique?

The benchmark symbolist NFT Collection stands out for its fusion of art and FinTech, offering authenticated digital assets that merge aesthetic value with cutting-edge provenance verification. This blend provides artistic and investment appeal, showcasing the innovative possibilities of blockchain technology.

How do Canadian artists benefit from the merger of contemporary art and FinTech?

Canadian artists gain more control over provenance and distribution through blockchain technology, improving market visibility and creating new revenue streams. This merger encourages a more inclusive art market, breaking down barriers for marginalized artists and enhancing overall market efficiency.